Trasti started its activity on the market at the beginning of March 2021 by introducing the motor third-party liability insurance offer. Trasti operates in Poland under the principles of the freedom to provide financial services (FoS) in the EU, as the General Agent of Zavarovalnica Triglav, the largest Slovenian-based insurer in Southern Europe, in cooperation with the global reinsurer Swiss Re.

Poland is the first and the most important market where we want to implement our InsurTech model. We believe insurance products are local, but the processes that support them can be global. Thus, this is how we design our operating model and technologies, says Artur Olech, CEO of Trasti.

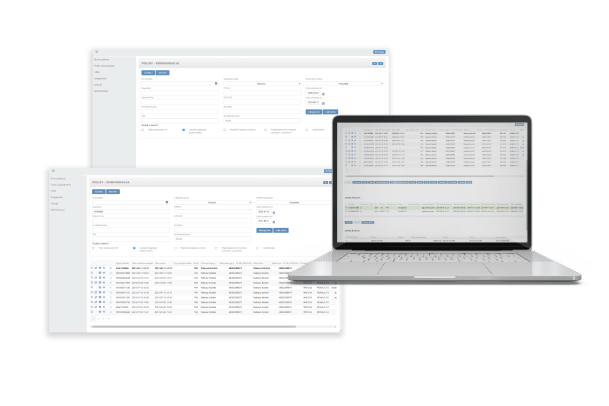

Makeitright has created software for a new insurer on the Polish market, using the FlexiBlock transaction system in the Microsoft Azure cloud. This is the first such commercial implementation in Poland. In the case study, we discuss the challenges we faced and the problems we had to solve in order to introduce the new insurer to the market.

More about Trasti:

www.trasti.pl

Defining the client's goal

Our goal was to launch a new insurance company and bring it to the Polish market.

Four elements were crucial for the client:

- Entering the offer on the market in the shortest possible time (maximum 6 months).

- Limitation of the investment (the client did not want to buy servers and the entire system with a license as the costs were to be spread over time).

- Launching the insurance system in the cloud (it allowed for quick implementation, without the need to build the entire infrastructure, e.g., purchase of servers).

- Integration with the company’s largest partners. Trasti cooperates with the global reinsurer Swiss Re.

Entering rankomat.pl and mubi.pl comparison engines

On the insurance market in Poland, diversified sales in many channels and credibility in the most popular internet comparison websites rankomat.pl and www.mubi.pl are of key importance. Potential customers visit them to compare prices and see how much the selected insurance may cost. The offer must be returned to the customer quickly, as the time of receipt of the offer is crucial in the customer’s purchase decision and the choice of the insurer.

Makeitright faced a technological challenge – adapting the system to the independent scaling of individual components depending on the characteristics of the traffic observed at end customers – i.e., customers in Internet channels and the pre-market network. The system should maintain a stable response time regardless of the volume of inquiries while allowing for handling load peaks and a variable volume of inquiries appearing at different times of the day. All scaling should be done in the background, cost-effective, and transparent to end-users

The key elements to meet these challenges were:

- We have integrated the FlexiBlocks system with comparison engines by setting several API services supporting the full sales process.

- All modules involved in the sales process were based on scalable components of the Azure cloud. For this purpose, we use both PaaS and Iaas solutions. This allows us to adapt all systems used in sales channels to the changing characteristics of the traffic.

- Additional support at effective implementation and scaling changes in minimizing “downtime” use containerization and orchestration technology based on Docker and Kubernetes.

- We have introduced multi-level caching, allowing us to minimize the load on the data layer, which is often the least efficient element of the system.

- We launched the system that returned the price to the comparison engine in about 3 seconds (the client’s goal was max. 5 seconds), even though many queries to external systems such as UFG, CEPiK, and other experts are carried out in the background.

- All external services are actively monitored so that we can proactively react to problems with our partners.

For Trasti’s client, we have built a comprehensive system in six months – twice as fast as the competition (average implementation time for the competition – 1 year).

Such a fast implementation time was achieved because we already had the FlexiBlocks system ready, and we got it to be integrated with the Microsoft Azure cloud. We also had experience in introducing new insurance entities to the market. The team behind the successful implementation for Trasti previously carried out the entire process of BRE Ubezpieczenia, i.e., MBank’s former insurance brand.

Our solution for Trasti consists of:

- the proprietary back-end FlexiBlocks system that handles the data processed in the system

- dedicated communication system with Trasti clients (front-end)

- Integrated transactional system for an insurer available as a service in the Azure cloud

- A unified system for managing an insurance company supports inter alia, claims to handle, or after-sales service. The system has been integrated with the largest and partners of the client

- BrokerUFG solutions that support the client’s communication with UFG and CEPiK

- innovative interface in the agency channel, which is functional, convenient, and transparent for the user, as well as aesthetic

- Case Pro system, i.e., the data computation engine.

Within one month (May 2021), we handled a total of about 607,000 requests for the calculation of the offer.

On the busiest days, we had about 27,000 calculations a day. Below is a diagram that shows how this volume is distributed over particular days.

"

“The Makeitright company has built software for us according to the latest design principles. The FlexiBlock transaction system is innovative, meets all quality and safety standards in the financial market. It supports the insurance products we offer, is convenient and simple. The solutions proposed by Makeitright are scalable and easily adaptable to other markets,”

Artur Olech, CEO Trasti

Next steps in cooperation

1. Entering into the agency sales channel

Many companies on the Polish market have their own insurance systems and a network of agents who receive a commission depending on how the customer insurance process proceeds. Makeitright faced the challenge of implementing an insurance system for Trasti so that insurance agents could also use it.

- We will introduce a system that integrates with ISI, a solution implemented in several networks of insurance agencies.

- Agents will work on the ISI solution with which FlexiBlocks integrates.

2. Entering into the direct sale

Makeitright company will guide the client through the process of creating their own portal through which anyone who wants to be insured will go.